In a terrible year for stocks, it’s little surprise that the best-performing sector is the utilities. But is there a risk that these bond-like stocks are becoming overvalued?

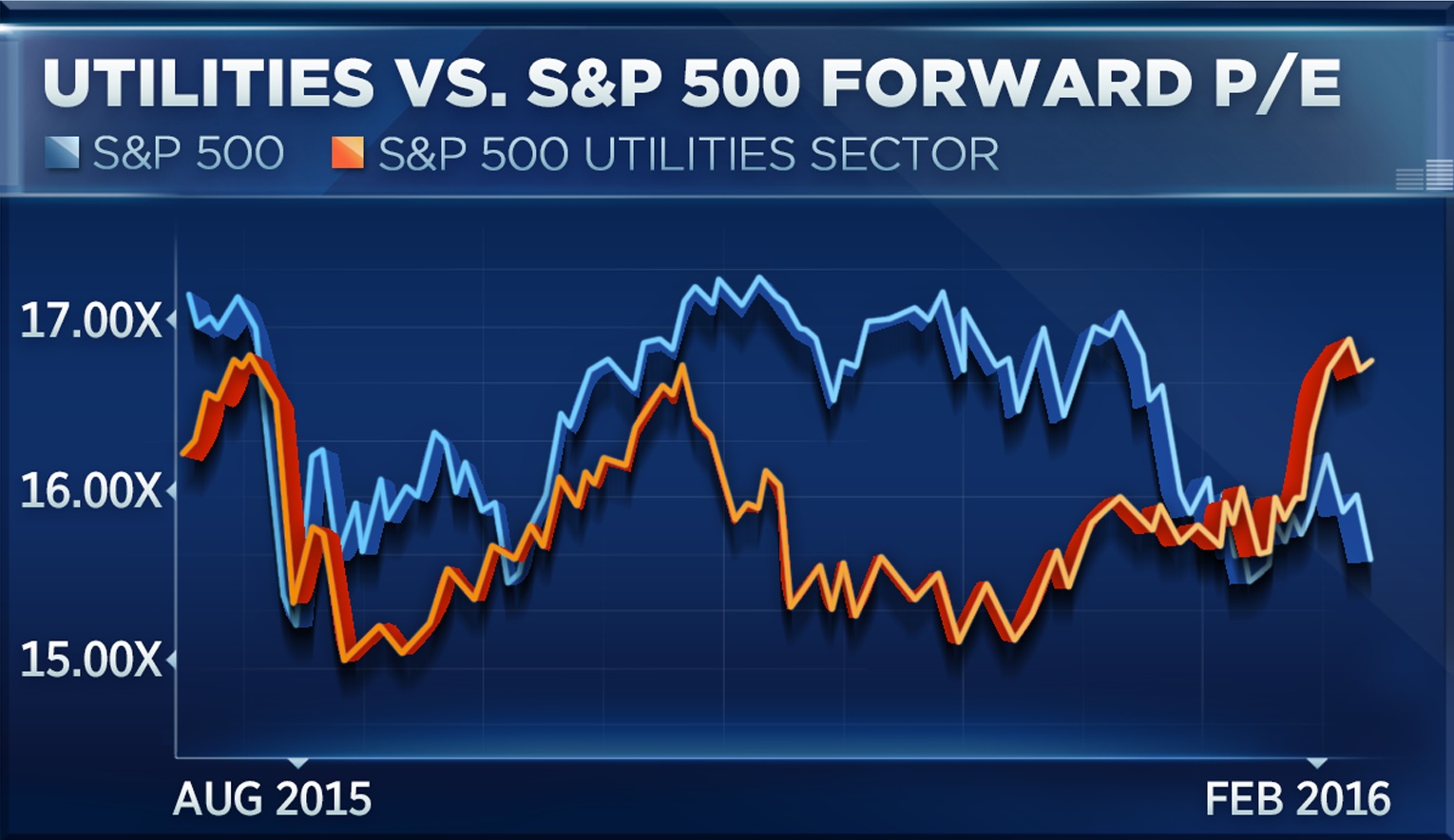

On a price-to-earnings basis, the utilities have become richly valued indeed. Based on the popular comparison of utilities’ share price with analysts’ expectations of earnings over the next year, utilities have not just seen their valuations rise, but also now look more expensive than stocks as a whole.

“That definitely says people are placing really high value on these things,” commented Erin Gibbs, equity chief investment officer at S&P Investment Advisory, in a “Trading Nation” segment Monday. But “we don’t really see the value or the opportunity right now … they’re too rich.”

However, if investors are using the utilities stocks as a proxy for bonds, another framework suggests itself. The past-year dividend yield of theSPDR Utilities ETF (XLU) is 3.4 percent, which compares to a 10-year Treasury yield of 1.7 percent and an investment-grade corporate bond yield of 3.6 percent.

That spread of 1.7 percentage points to the 10-year Treasury yield is slightly higher than the average seen over the past five years, which would suggest that utilities could be fairly valued.

On the other hand, the difference between high-grade corporate bond yields and utilities dividends has risen, suggesting that owning utilities has become less attractive compared to simply owning corporate bonds.

This may be the more relevant measure, since higher perceived economic risks should push up required corporate bond yields and dividend yields alike, whereas Treasury bonds are considered to have no default risk.

Similarly, comparing the yield on utilities stocks to the yield on the overall S&P 500 (as judged by its congruent ETF proxy, the SPY) shows that utilities investors are now earning a much smaller premium than they have become used to over the past few years. That is to say, with the S&P 500 falling and utilities stocks rising, the dividend spread has come in considerably.

However one assesses the utilities, one thing is clear: Investors are clearly paying up for their perceived safety in an unsafe-seeming world, and for their relatively high dividend yields in a low-rate world.

The question is whether investors who jump into the trade now are making the mistake of paying too much.

“They’re very long in the tooth,” warned Societe Generale macro strategist Larry McDonald, also on “Trading Nation.” The time to buy these stocks, he said, is when good economic data come out, and “nobody wants to be in utilities.”

[“source -cncb”]