So much for 2016 being the year of the stock picker.

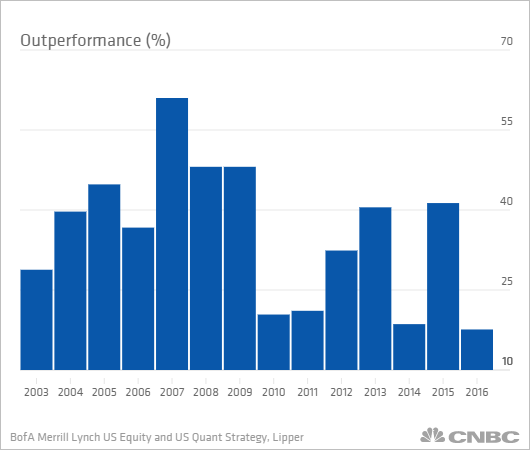

In fact, this has been the year investors wanted to do anything but try to pick stocks. Active fund managers had their worst first half ever, with fewer than one in five beating a basic market benchmark, according to data from Bank of America Merrill Lynch that go back to 2003.

Stock pickers were done in by two major factors: following the crowd and an uneven pattern of correlations among stocks. The 10 most-crowded stocks lagged the 10 least-owned by a whopping 18 percentage points, which BofAML called “an atypically high spread.”

The opportunities are there for stock picking, but the pros still have faltered. Correlations, or the tendency of stocks to move up and down together, had been falling but rose in June to 35 percent, a number that is still low compared with levels of 90 percent or higher in recent years but high enough to be disruptive.

“This makes the environment more challenging for active managers when stocks are more correlated with one another,” BofAML said in a note. The firm noted that dispersion, or the difference in performance between sectors, also has remained narrow, further limiting opportunities for stock picking.

“While intra-stock correlations had been trending down for most of the year, they spiked again in the period surrounding Brexit as macro came back into focus,” the note said. “Long-short alpha opportunity also remained scarce, another challenge to stock pickers.”

The active fund industry has been fighting to stave off a market trend where dollars have been flowing heavily into passive funds that track indexes rather than rely on individual stock picks. The $3 trillion global exchange-traded fund space took in $24.5 billion in June alone, part of a pattern that has seen $117.9 billion in inflows for 2016, according to State Street. That is behind trend compared with 2015, though ahead of the $13.2 trillion mutual fund industry, which saw outflows of $46.9 trillion in the first five months of the year, according to Investment Company Institute data.

Overall, just 18 percent of large-cap fund managers have beaten the Russell 1000 benchmark for 2016, with the number rising to 22 percent in June. The average fund fell 0.7 percent in the month. In the entire active fund industry, just 17.6 percent have topped the benchmark, BofAML said. The best year for active was 2007, in which 61 percent outperformed; the total was 41.3 percent in 2015.

Those managers who did well focused on high quality, which the BofAML analysts said are “still cheap, underowned, fundamentally attractive and a good hedge against volatility and market downturns, in our view.”

Value stocks also are beating growth — by nearly 5 percentage points, which is the biggest margin since 2006. Funds with fewer holdings and big stock but not heavy sector positions also fared well.

BofAML has been cautious on the market, and warned that some of the tailwinds for stocks, like activist campaigns, share buybacks and deals, are fading after helping to propel the second-longest bull market ever.

“With deals being struck at higher multiples, and buybacks executed at higher prices, acquirers have underperformed this year, and share buybacks have lagged for over two years,” the note said. “This smacks of a late stage bull market: the levers of cheap financing and corporate re-tooling have been largely exhausted.”

[“source -cncb”]