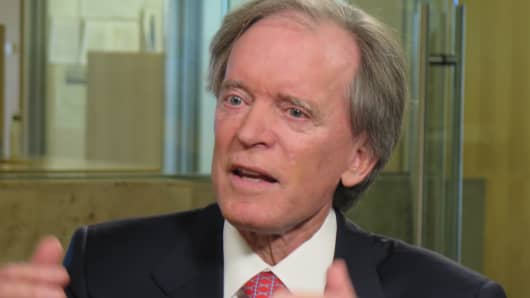

The rivalry between Bill Gross and his former company Pimco looks set to hinge on the performance of the US economy this year, as the two take diverging views on the outlook for interest rates.

Mr Gross’s new fund at Janus Capital has opened up a wide lead over its counterpart at Pimco thanks to financial markets that have more closely reflected the veteran bond investor’s gloomy prognosis.

The Pimco Unconstrained Bond fund has lost more than 3 per cent so far this year after positioning itself for Federal Reserve rate rises that the markets now suggest might not come. Mounting losses are adding to the woes of the fund, which has lost two-thirds of its assets through client withdrawals since Mr Gross was ousted in September 2014.

Mr Gross’s Janus Global Unconstrained Bond fund now ranks 17th out of 100 in Morningstar’s non-traditional bond fund category for the past year, but it is still losing money despite promising clients positive absolute returns over the long haul. The fund is down 0.4 per cent since the start of the year.

“Now I’ve crawled into the higher quartile of relative performance, I feel an obligation to deliver absolute performance — or one could say, ‘what are you doing here?’,” Mr Gross told the Financial Times.

More from the Financial Times:

Monitise losses stack up after £167M writedown

Ex-trader files Carlyle whistleblower suit

Lending Club announces share buyback

In common with many unconstrained funds, which were sold as alternatives to traditional bond funds that might suffer in a rising rate environment, the Pimco fund has positioned itself to benefit from higher bond yields. Instead, yields have fallen this year, the market has priced in fewer rate rises than the Fed has forecast and economists have signalled rising risks of a recession.

“Our view is that the US economy continues to perform at a pace we define as solid, despite its ebbs and flows and periods of volatility,” said Marc Seidner, who runs the fund with Mohsen Fahmi and Pimco’s chief investment officer Dan Ivascyn.

“The environment is appropriate for the Federal Reserve to begin to remove monetary accommodation. The market oscillates between fear of collapse and euphoria, but our long-term perspective suggests something in the middle, an economy that is fine, solid,” Mr Seidner said.

Mr Gross said he feared a “Big Short 2” scenario, referring to the recent film about the credit crisis.

“The global economy is highly levered and monetary policy — the only leg of government policy that has been employed to boost economic growth — has been relatively ineffective in producing acceptable levels of nominal GDP growth,” he said.

The difference of opinion has added piquancy because of the bad blood between Mr Gross and Pimco. Last year, Mr Gross sued his former firm, alleging constructive termination and demanding more than $200m in unpaid bonuses and damages. Pimco says the suit has no merit.

The turmoil caused by Mr Gross’s exit led to widespread customer redemptions at Pimco, particularly from funds he used to run. He took over management of the Pimco Unconstrained Bond fund in 2013 when it looked as if customers might shift into non-traditional funds from those like the flagship Pimco Total Return Bond fund that he also ran.

He has also pursued complex strategies such as selling volatility and protection against sovereign debt defaults that differentiated his fund from the Pimco fund, although he now admits that he took on too much risk. The swings in his performance at one time put him close to the bottom of his peer group and George Soros, who had given Mr Gross $500m to manage, pulled his money out last autumn after a pair of precipitous drops in the value of the fund.

“The experience in the early days here at Janus was a little too volatile,” Mr Gross said, “and despite my construct on the negative implications of debt, you can’t be totally confident that central banks won’t attempt another rescue so you have to limit your total exposure from these types of bets.”

Overall, since Mr Gross started managing the Janus fund in October 2014 it has returned minus 1.3 per cent, according to Morningstar, putting it at 26th out of 100 non-traditional bond funds for the period. The Pimco Unconstrained Bond fund is down 5.6 per cent over the same period and is at 62 out of 100.

The losses have compounded Mr Gross’s difficulty in raising money. Of the $1.3bn in his fund, some $700m is his own money. Assets in the Pimco fund have contracted from $18.3bn shortly after Mr Gross left to $5.5bn at the end of January.

“It’s easier to sell relative absolute performance than relative performance,” Mr Gross said. “I hope to have both as we proceed through 2016.”

Asked what time period he should be judged over, he said that if the fund had a good record after two or three years, “then I could pat myself of the back” — but he added he saw no likelihood of retiring.

“What I said at Pimco was, ‘as long as you’ll have me’, which turned out to be an unfortunate phrase. I will do this as long as they’ll have me at Janus, and as long as I can keep it together and not suffer a long period of underperformance.”

[“source -cncb”]