When the Dow Jones industrial average was down more than 400 points Monday afternoon, it was weighed down by a sell-off in Goldman Sachs stock before it partially rebounded.

Of course, the Dow is not the market — it’s just 30 major stocks out of the thousands traded on American exchanges. Most of the time, those stocks move along with the rest of the market, but sometimes the structure of the index lets a few companies like Goldman Sachs swing the Dow up or down. At the same time, some of the companies in the Dow have almost no impact.

The index is calculated by simply adding up the stock prices of the constituents and dividing by the “Dow divisor” to adjust for stock splits over time. That means companies with higher prices (or less outstanding stock) have a greater influence over how the index moves, even if the cheaper companies are a bigger part of the market.

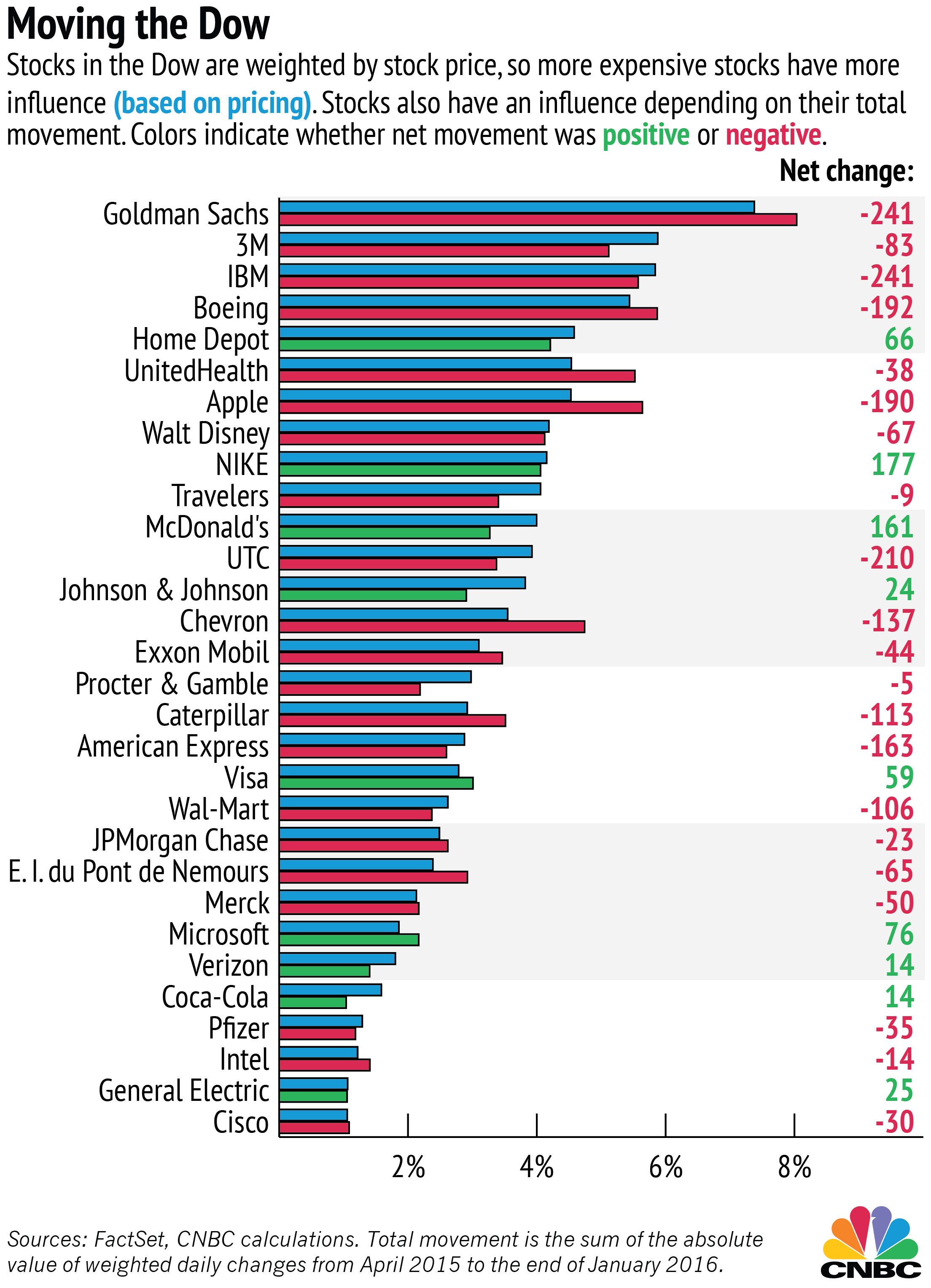

Stocks also must have a price change to cause a shift in the index, and some companies, like Chevron, Apple and Goldman Sachs, have had a bigger impact recently than their stock prices would suggest because of higher volatility. Here’s how each company has moved the index relative to their average price weight since April.

Over the 10 months since April, high priced companies like Goldman ($147 as of Monday’s close) and IBM ($125) are nearly always the top movers, accounting for a combined 15 percent of the total weighted movement in nearly every month.

In contrast, cheaper stocks like Pfizer ($28), General Electric ($28) andCisco ($23) often account for less than 1 percent of the movement, although GE is worth four times more than Goldman Sachs.

That means that if GE went to zero tomorrow, erasing $278 billion in value, the Dow would react the same as if Goldman Sachs fell only 19 percent. On the flip side, a nearly 7 percent devaluation of Goldman Sachs can drop the Dow about 70 points, as we saw on Monday afternoon.

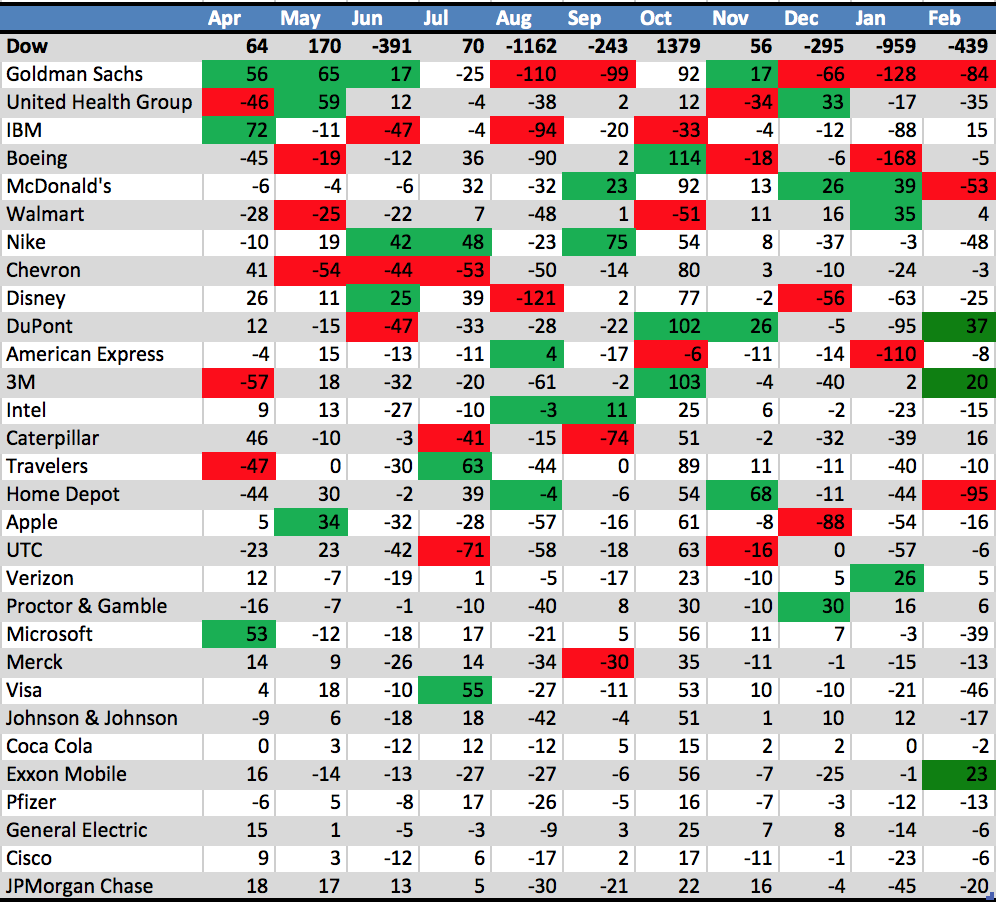

Here are the top three biggest net positive and negative movers for each month (including February as of Monday’s close):

Luckily, most of the stocks in the Dow tend to move in the same direction in a given month, so even if the hypothetical death of GE would remove only about 1 percent from the Dow, the Dow still generally represents the movement of all of the its cheaper components.

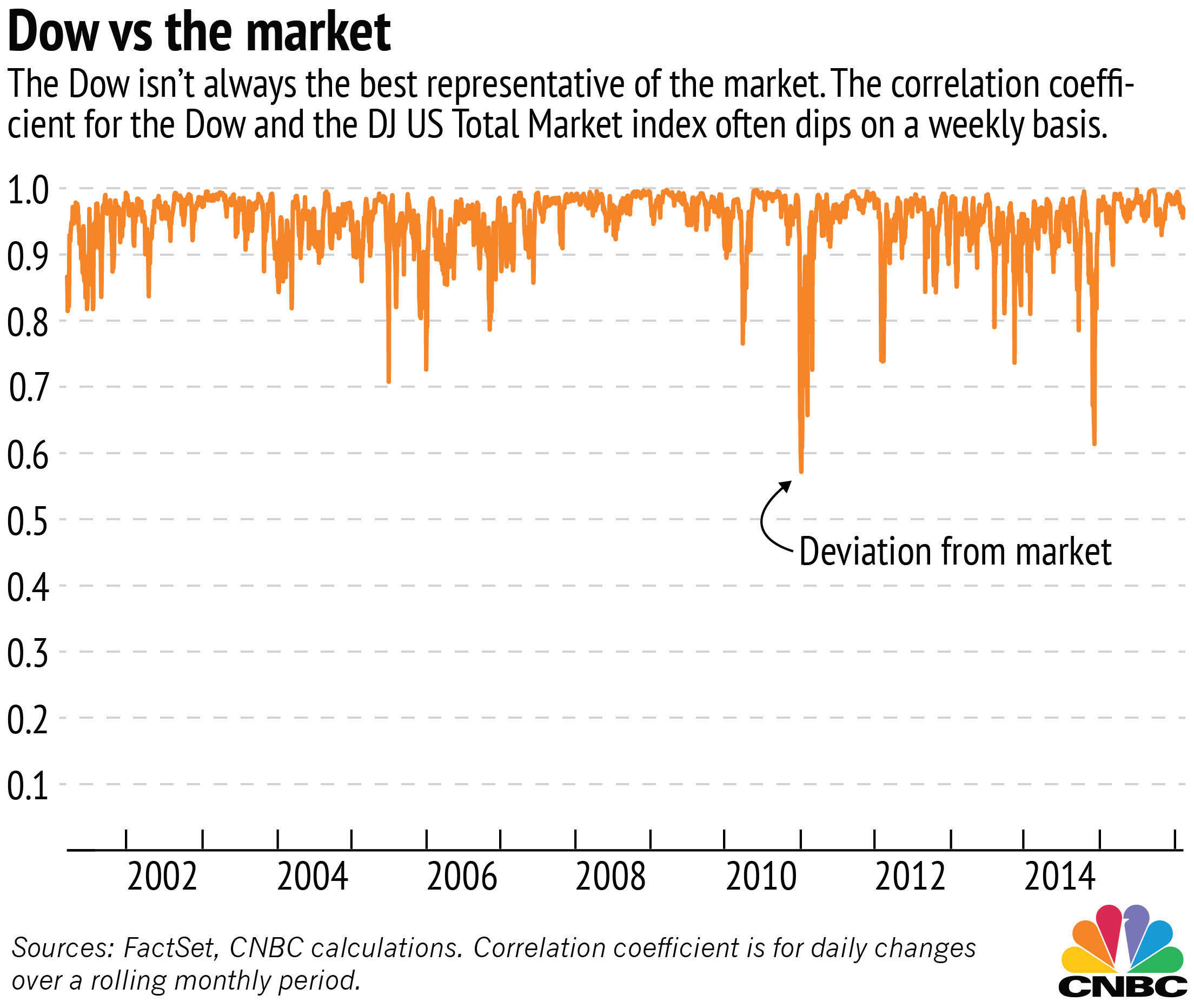

That’s why over the last 15 years, the daily movement of the Dow has been almost 97 percent correlated with the market as measured by the DJ US Total Market index. That’s not bad, but it falls short of the S&P 500, which is 99.7 percent correlated.

Those missing 3 percentage points are lost in weeks when the Dow’s small sample of companies and price weighting makes it deviate significantly from what the rest of the market is doing.

If we look at the rolling daily correlation for each month, it becomes clear that the Dow is not always the best representative of the market during some months. There are weeks when the Dow sees a decrease while the market as a whole increases in value.

Frequently, a single stock accounts for much of the Dow’s movement in a day. Since April, there have been more than a dozen days when at least 25 percent of the movement in the index was attributable to a single stock. In more than 80 percent of the days over that period, one stock accounted for at least 10 percent of the movement.

That’s a lot of power for a single stock to have, considering how many companies are publicly traded as part of the market the Dow is taken to represent. It makes it easy for one stock to make things seem better or worse than they really are.

Unfortunately, that doesn’t seem to be the case over the last few weeks. As of Monday’s close, the Dow is down 2.6 percent over the last week, and the S&P 500 is down 4.4 percent. All but three Dow stocks (DuPont, IBM and Caterpillar) are down over the last week, and the Dow has been 97 percent correlated with the market over the last month, which means that this decline is the real deal.

[“source-gsmarena”]