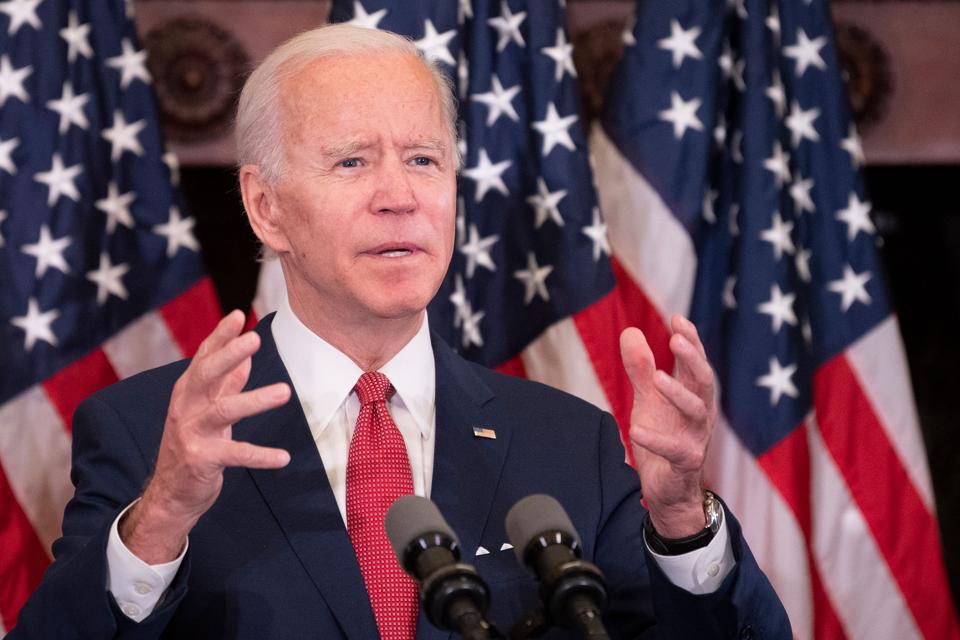

The 2020 election may be the most consequential election in history for student loan borrowers. So much is at stake – including the continuing existence of critical federal student loan programs, as well as the possibility of dramatic reforms, such as widespread student loan forgiveness.

And while the media focus has been largely on the presidential election, the makeup of Congress following the election will also matter enormously. The entire House of Representatives is up for re-election, and a third of the Senate is, as well. The composition of both chambers of Congress following the election will have enormous consequences for student loan programs and student loan reform.

Here’s what’s at stake.

Public Service Loan Forgiveness

The Public Service Loan Forgiveness program is a critical program that forgives qualifying federal student loans after 10 years (120 “qualifying” monthly payments) if the borrower is employed full-time by a nonprofit or public organization. Millions of borrowers have taken advantage of this program, choosing lower-paying career paths with the understanding that there would be eventual student loan forgiveness.

Public Service Loan Forgiveness has been repeatedly targeted for repeal, however. House Republicans proposed repealing the program via the PROSPER Act; the bill never passed, and it would have grandfathered in current borrowers, but the danger to the program was (at the time) very real. In addition, the Trump administration has proposed de-funding Public Service Loan Forgiveness through the budget process. The White House pushed to gut Public Service Loan Forgiveness in 2017, and again in 2019, but neither proposal passed Congress.

The outcome of the presidential election, and the makeup of Congress, will likely determine the fate and the future of Public Service Loan Forgiveness.

Borrower Defense to Repayment

The Borrower Defense to Repayment program was established by the Obama administration to provide relief to students who were defrauded by predatory schools. Borrowers can apply to this program and request that eligible federal student loans be forgiven if their school engaged in unfair, deceptive, or illegal conduct that caused them financial harm.

Since Betsy DeVos took over the U.S. Department of Education in 2017, however, the program has been mired in ongoing political and legal battles. DeVos has attempted to rewrite the rules governing the program, reducing or gutting its protections and the relief available to borrowers. DeVos’s administration has also failed to process tens of thousands of Borrower Defense applications, leaving many borrowers in legal limbo for years. President Trump recently vetoed bipartisan legislation that would have restored the Borrower Defense program’s protections.

The future of the Borrower Defense program is uncertain. But whoever controls the U.S. Department of Education following the 2020 election will have enormous control over how the program is administered going forward.

Income Driven Repayment

Millions of borrowers rely on income-driven repayment plans to repay their federal student loans. These plans use a formula applied to the borrower’s income to calculate their monthly payment, and the payment amount gets periodically adjusted as the income changes. Any remaining balance would eventually be forgiven after 20 or 25 years, depending on the plan.

There is general bipartisan agreement that the current income-driven repayment system – which is essentially a patchwork of several plans, each with its own quirks, eligibility criteria, and payment formulas – is deeply flawed. But there is no agreement on how to fix it, and no single proposal has garnered sufficient support to pass Congress.

Broad Student Loan Forgiveness

There are currently at least five proposals for broad, widespread student loan forgiveness:

- The Opportunity for Heroes Act provides targeted relief to essential workers.

- The “Student Loan Forgiveness for Frontline Healthcare Workers Act.” provides relief to healthcare workers.

- Senate Democrats have proposed $10,000 in across-the-board student loan forgiveness.

- House Democrats have proposed $30,000 in across-the-board student loan forgiveness via the Student Debt Emergency Relief Act.

- Joe Biden has proposed widespread student loan forgiveness for undergrads who attend public institutions.

No single proposal has, so far, garnered enough support to pass both houses of Congress and be signed into law by the President. The 2020 election could change that, however.

source: forbes