Executive summary

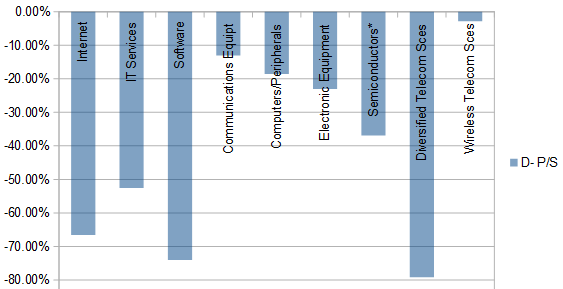

Looking at their historical averages in 4 metrics, Communication Equipment is close to fair price and Semiconductors are not far behind. The Computers/Peripherals industry has mixed ratios: P/E and ROE look good, but not P/S and P/FCF. Other IT and Telecom industries are significantly more overvalued. However, all groups except Diversified Telecom Services are above their historical baseline in profitability, which may partly justify overpricing. Anyway, I think systemic risk is more important than market valuation to manage a portfolio.

Since last month:

- P/E has improved in Telecom, is stable in Communication Equipment and deteriorated in other IT industries.

- P/S has improved in Computers/Peripherals and deteriorated elsewhere.

- P/FCF has improved in Computers/Peripherals, is stable in Electronic Equipment, Wireless Telecom and deteriorated elsewhere.

- ROE has improved a bit in all groups except Wireless Telecom (stable) and Computers/Peripherals (deterioration).

- The Technology Select Sector SPDR ETF (XLK) has outperformed the SPDR S&P 500 ETF (SPY) by about 1%.

- On this period, the 5 best performing S&P 500 Tech or Telecom stocks are Alliance Data Systems Corp. (ADS), Akamai Technologies Inc. (AKAM), Advanced Micro Devices Inc. (AMD), CenturyLink Inc. (CTL), and Nvidia Corp. (NVDA).

Some cheap stocks in their industries

The stocks listed below are in the S&P 1500 index and cheaper than their respective industry factor for Price/Earnings, Price/Sales and Price/Free Cash Flow. The 10 companies with the highest Return on Equity are kept in the final selection.

This strategy rebalanced monthly has an annualized return about 12.76% in a 17-year simulation. The sector ETF XLK has an annualized return of only 2.83% on the same period. I update every month several lists like this in various sectors. Quantitative Risk & Value Members have an early access to the stock lists before they are published in free articles. Past performance is not a guarantee of future result. This is not investment advice. Do your own research before buying.